Before they decided to start VentureNursery, India’s first angel-backed startup accelerator, Shravan Shroff and Ravi Kiran had traversed different routes in their lives. Both came from business families – Shroff’s family was into movie distribution and Kiran’s was into jewellery. Neither had joined the family business. Shroff had built a compellingly powerful business in the entertainment industry, founding and building Fame Cinemas, taking it to IPO and then exiting, while Ravi Kiran had dedicated twenty years to the corporate world, building and running operations, creating strong new models, in global conglomerates in Marketing and Communications – IPG Group and Publicis Groupe.

A chance meeting at Indian School of Business Hyderabad, where they shared place on a panel in 2010, followed by another one at a Mumbai Angels meeting a year later, led to the founding of VentureNursery.

The idea was simple,

To coach startup founders who had no dearth of exuberance, but had a certain lack of entrepreneurial experience and understanding of the nuances of building and running a business.

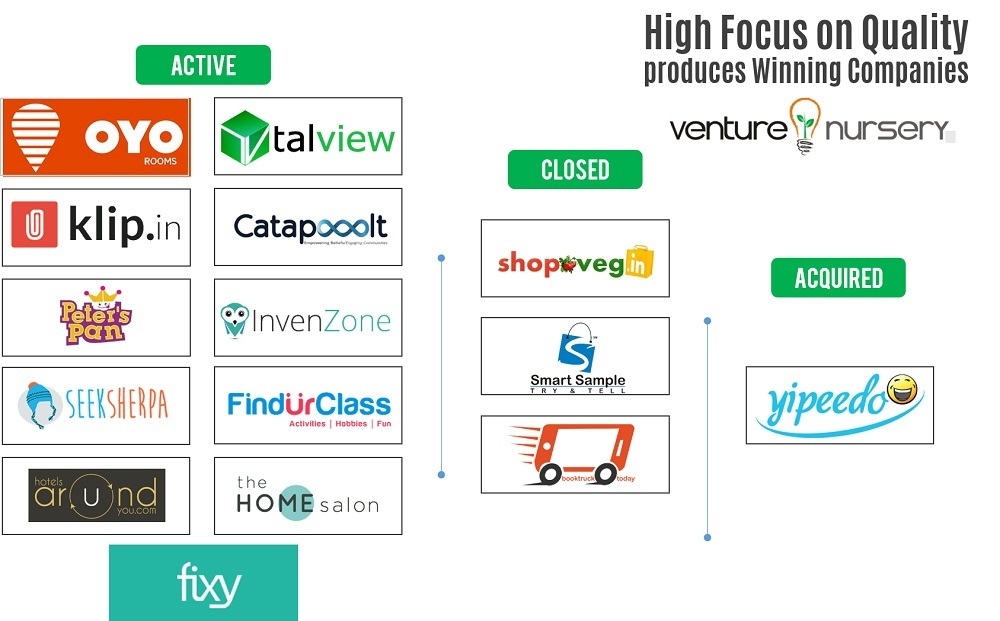

VentureNursery aimed to identify gaps in startups and plug them systematically, in order to set the founders on the right course. Founded in March 2012, VentureNursery has accelerated 21 startups until now, of which 16 have graduated, 12 are active and growing well. Beginning with twelve angel investor members (including Shroff and Kiran) and 17 Mentors-in-Residence in 2012, VentureNursery, currently has 30 members and nearly 80 Mentors-in-Residence.

Based on its belief that the venture ecosystem needs to focus primarily on maximising the success potential of founders and startups, VentureNursery undertakes intensive and immersive coaching and mentoring role in the chosen startups and helps each with end-to-end infrastructural and learning support. With an obsessive focus on quality, VentureNursery, currently, conducts two to three boot camps a year in Mumbai and accommodates a two startups in each for a three-month period. It also runs a separate program called ParallelTrack whose duration may vary between ten and forty weeks. Both programs involve heavy customization based on the startup’s requirements.

The VentureNursery Alumni include branded budget hotel chain OYO Rooms, video interview platform Talview, fashion and lifestyle social commerce platform Klip, crowdfunding platform Catapooolt, travel startup SeekSherpa, artificial general intelligence company InvenZone, last minute hotel booking company Hotels Around You among others.

In an exclusive chat with Inc42, Ravi Kiran spoke about the program, the intent and the angel investing scenario in India.

Criteria For Selection

The most important criteria for a startup to be considered for admission to VentureNursery program is whether there is a real, large and preferably growing market for the startup. If the founders have identified the market, it’s even better. Founders learn to identify the market, validate the problem and often refine the market definition during the acceleration program. Says Ravi, “About 80% of new businesses shut down due to poor product market fit.”

A good product market fit ensures that the business will have real customers who will want to pay for the product or the solution. It is also evaluated, whether the market identified is a growing one or is it just a passing faddish market. So it is important that the problem identified is one that is worth solving and it is intense in nature i.e. lot of people are facing that problem and they should want a solution rather urgently.

The accelerator also looks at the founding team’s commitment to the problem, their ability to solve it, their willingness to stick to it, and whether they are disciplined enough to see it till the end. “Sometimes, the founders just come to us with a hint of an idea, and during the course of the program, they are able to identify the real problem,” Ravi added.

It started with focus on six sectors, but is now open to accept applications in 18-20 different sectors. As long as a startup has identified or can identify a real world problem and there are customers who would want that solution, it matters less which sector it is operating in.

The Program

For every program or batch, (the company calls it a ‘Season’), the accelerator receives between three hundred and four hundred applications. At the end of a rigorous five stage screening process, only five finally make it to the program, and now this number has been reduced to two since last year. If the company does not feel strongly about the applications, it defers the commencement of the program, rather than start it just to stick to a date. Till date, it has conducted seven batches, accelerating a total of 21 startups. Of these, sixteen have graduated, 10 have been funded and 12 are active and doing well.

Following a highly customised curriculum, delivered by industry leading mentors over multiple one-on-one sessions, the three most important things each startup learns during the program are identification of right problems, achieving product-market fit and decision making. At the end of the program, or by Graduation Day, which is typically the 95th day of the program, the startups must have started to build a solution around their identified problems.

At the end of each program, startups graduating successfully are evaluated by VentureNursery’s members, a strong group of committed and seasoned angel investors. Graduation is not easy, with about 30% of the startups not making it. If the members approve the graduation of a startup, VentureNursery’s Investment Council, consisting of three of the most experienced members, recommends the investment terms. Actual investment is done by each individual member, independently and voluntarily, without any canvassing or persuasion by anyone.

The investment size could range anywhere between $15K and US $123K (INR 10 – 80 lakhs), with the average ticket size being $92K (INR 60 lakh). The amount depends on the stage of the company, and how much money it requires to sustain for up to 18 months, refining the product, hiring talent and getting to Proof of Concept and customer adoptionable business. The recommendation of the Investment Council include investment quantum, valuation, founder compensation, tranches of fund release, ESOP pool creation and the milestones to be achieved.

VentureNursery members invariably try to dilute the founders share as little as possible at this stage, enough for the investors to stay motivated as well as the founders to retain maximum possible stake for dilution in subsequent rounds of money raising.

Simultaneously, the accelerator also runs the ParallelTrack program for startups that are either too raw or already into building the venture. For these, the program duration is altered based on recommendation by the VentureNursery Selection Council. These startups are accelerated for anywhere between ten and forty weeks.

Whether in the standard 90-day Bootcamp or the flexible ParallelTrack, VentureNursery claims to customize everything about the program for each startup. “That’s where our founder friendliness is the most evident”, says Kiran.

The Mentors

The Mentor-in-Residence program at VentureNursery started out with mostly friends and business acquaintances of founders, who agreed to give 9-10 hours of their time, every quarter, to startups, over multiple sessions, helping the startup in a key gap area. As the program expanded, the accelerator claims to now count nearly eighty individuals as MIRs who impart startups with the soft hacks of running a business. The notable thing is that mentors work pro-bono with the startups and are spending time to keep pace with the new ideas and new businesses.

In addition to mentors, it also has 30 angel investors as its members, who actively support promising startups through investments and also tap their networks to bring invaluable business connections and often next round investments to the VentureNursery alumni ventures. These members pay a nominal support fee, which contribute about 10% of the expenses of the organisation. The rest comes from the personal investment of the founders.

The Angel Investing Scenario

“Many investors today want to enter the angel investing space with an investment mindset to multiply their investments. They consider angel investing as merely an investment asset class. However, they don’t realise that angel investing means you have to play the role of an angel and literally adopt the startup. You should be interested in genuinely helping the founder to build a business.” said Ravi.

The intent of the angel investor should not be to throw money. He notes that not many ultra-HNIs are willing to invest in the angel space, although the number has been growing steadily. Seasoned investors are the ones who are drawn more to the space, and recognise the fact that angel investing can be a very rewarding learning experience.

Commenting on the sectors which are drawing more angel investors, Kiran said that as with other industries, waves happen in this space as well. “We have seen the ecommerce wave, the mobile apps wave. Now we see the hyperlocal wave and the IOT wave. I don’t think waves are bad but doing random investing just on the basis of a wave, can make good money turn to bad money quickly.”

Advice For Startups

For him most important ingredients for a startup should be commitment to success and personal discipline. The founders should have a determination to solve real world problems. In addition to this passion and determination, they also needs to have the personal discipline to see through things and work out a solution.

Many people have a lot of passion to solve such problems, but lack the discipline required to set up a successful business. He adds that startups should be ready to do whatever it takes to occupy the pole position in the space they operate. “If you want to take the pole position for instance Oyo did in the branded accommodation space, then you have to be before the wave.” The fact that not a single startup funded by VentureNursery has shut clearly substantiate the wisdom of the founders and the prowess of VentureNursery’s program.

The Accelerator Space

There are many other accelerators in India which are active in the startup ecosystem with different funding ranges, mentorship programs, focus areas, and equity terms. For instance, Hyderabad-based Catalyzer Startup Accelerator Program is a 101-day mentorship-driven entrepreneurship cohort accelerator program for startups. Twice each year, it selects up to 12 startup teams (or individuals) and helps them navigate the crucial first stage. Selected startups receive financial support in the form of pre-seed capital, work space, IT facilities and other resources. It provides funding in the range of $7.6K-$15.2K(INR 5-10 lakhs) on 7-12% equity.

Gurgaon-based GSF Accelerator is a 13-week program, which aims to provide select startups with unparalleled access to venture and business networks, personalized & intensive mentoring, and initial capital. GSF Accelerator is designed to help product-oriented startups. It provides funding in the range of $25K-30K for 5-8% equity.

Bangalore-based Kyron has introduced a new concept of ‘pre-accelerator’, which will admit about 20-25 startups. Such startups will be put through a six-month incubation period after which some would be handpicked by Kyron for its accelerator batches. It provides funding of upto $20k for 5-10% equity.

Focused on promising early-stage startups or first-time entrepreneurs, Bangalore based Microsoft Accelerator runs a program of 4 months, starting in January and July every year. Selected startups get strong mentoring, technical guidance and connections to other startups.

Times Internet’s TLabs accelerator, powered by a panel of 70+ mentors – that includes highly-experienced entrepreneurs and industry professionals, TLabs runs a structured and highly intensive four-month mentoring program for these startups. It also offers a funding of $15.2K (INR 10 lakh) for 10% equity, a co-working space and a host of other benefits from prominent tech partners, to the startups it accepts for the program.

Founded by Dave McClure, famous angel investor from Silicon Valley, 500 Startups runs a 4 month accelerator program open for all domains. It’s like a Startup MBA on steroids providing startups access to a network of 1000+ founders, 200+ mentors, and its staff for guidance and mentorship. It invests $100k in exchange for 7%, and charges a $25K program fee for a net $75K investment.

National Association of Software and Services Companies (Nasscom) also runs business incubator-cum-accelerators at Bangalore and Kolkata, and looking to open offices in Gurgaon, Navi Mumbai and Pune. Nasscom provides a central, well-connected, plug-and-play working space for startups to launch their operations, besides providing them one-on-one mentorship in line with its 10,000 Startups initiative to support technology entrepreneurship in the country.

Editor’s Note

While the above mentioned accelerators provide mentorship and funding on fixed terms, VentureNursery steers clear of that. It hasn’t fixed a funding amount or equity range for investing in startups. The program is run more as an adoption and grooming centre for startups to take them to pole position rather than potential investment targets to multiply venture capital. Ravi candidly states that the startup ecosystem has also seen a wave with a number of accelerators sprouting in the last couple of years.

VentureNursery clearly steers clear of such a wave, differentiating itself with its spirit of nurturing startups purely for the passion of it and not the moolah. It proudly follows what Ravi claims to be a ‘mentoring first’ model. That model has reared fast growing startups such as OYO Rooms, the poster boy in the branded budget accommodation space. However, with the increasing number of accelerators and competition in this space itself, it will be interesting to watch how many ventures would opt for VentureNursery and how many more such leaders will emerge from its nursery in the near future.