Yahoo is a company that changed the world. Now, we will continue to, with even greater scale, in combination with Verizon and AOL.

Reads Yahoo’ CEO Marissa Mayer’s letter to Yahoo’s moments after Verizon Communications Inc. announced that it will be acquiring Yahoo’s operating business for approximately $4.83 Bn in cash, subject to customary closing adjustments.

Lowell McAdam, Verizon Chairman and CEO stated, “Just over a year ago we acquired AOL to enhance our strategy of providing a cross-screen connection for consumers, creators and advertisers. The acquisition of Yahoo will put Verizon in a highly competitive position as a top global mobile media company, and help accelerate our revenue stream in digital advertising.”

Yahoo informs, connects and entertains a global audience of more than 1 Bn monthly active users – including 600 Mn monthly active mobile users through its search, communications and digital content products. So with Yahoo, Verizon gains the internet company’s 600 Mn monthly active mobile users, as well as its email service, Yahoo Finance, and micro-blogging site Tumblr, which is popular among millennials. Also included in the deal: the Yahoo brand and real estate attached to the core business including Yahoo’s headquarters in Sunnyvale, California.

However not included in the deal: Yahoo’s 15% stake in Chinese retailing giant Alibaba worth $32 Bn, and its 36% stake in Yahoo Japan, worth about $8 Bn, Yahoo’s convertible notes, certain minority investments, and Yahoo’s non-core patents (called the Excalibur portfolio). These assets will continue to be held by Yahoo, which will change its name at closing and become a registered, publicly traded investment company. Yahoo will provide additional information about the investment company at a future date.

The transaction is expected to close in the first quarter of 2017. Yahoo will be integrated with AOL under Marni Walden, EVP and President of the Product Innovation and New Businesses organisation at Verizon. CEO Marissa Mayer will help with the transition and could stay on long term, something she herself is keen on. Marissa said,

I’m incredibly proud of everything that we’ve achieved, and I’m incredibly proud of our team. For me personally, I’m planning to stay. I love Yahoo, and I believe in all of you. It’s important to me to see Yahoo into its next chapter.

Verizon’s Ambitions For A Global Media Company

With the addition of Yahoo to Verizon after it bought AOL a year ago in May 2015 for $4.4 Bn, Verizon will have in its kitty one of the largest portfolios of owned and partnered global brands with extensive distribution capabilities. Combined, AOL and Yahoo will have more than 25 brands in its portfolio including Yahoo Mail, Flickr, and Tumblr as well as AOL’s Huffington Post, Techcrunch, Engadget, MAKERS, and AOL.com.

Yahoo’s key assets include market-leading premium content brands in major categories including finance, news, and sports, as well as one of the most popular email services globally with approximately 225 Mn monthly active users. So what Verizon chief executive Lowell McAdams wants from this deal is to gain a slice of the booming digital advertising pie. As a leading US mobile phone network, Verizon already has a wealth of data from smartphone users, which was leveraged even more effectively by its purchase of AOL a year ago for its programmatic advertising technology. Yahoo, though, has struggled to build its mobile advertising business but its forte is its content which Verizon aims to leverage with this acquisition.

So Lowell is hoping to take on the likes of Facebook and Google by building a global media company. How successful will it be revealed in times to come? But for now, the idea is to combine two fading giants — Yahoo and AOL — to create a new mobile and online powerhouse, thus representing another competitive digital media unit for advertisers currently flocking to Google and Facebook.

Tim Armstrong, CEO of AOL added, “We have enormous respect for what Yahoo has accomplished: this transaction is about unleashing Yahoo’s full potential, building upon our collective synergies, and strengthening and accelerating that growth. Combining Verizon, AOL, and Yahoo will create a new powerful competitive rival in mobile media, and an open, scaled alternative offering for advertisers and publishers.”

The Company That Changed The World Is Changing To A Holding Company

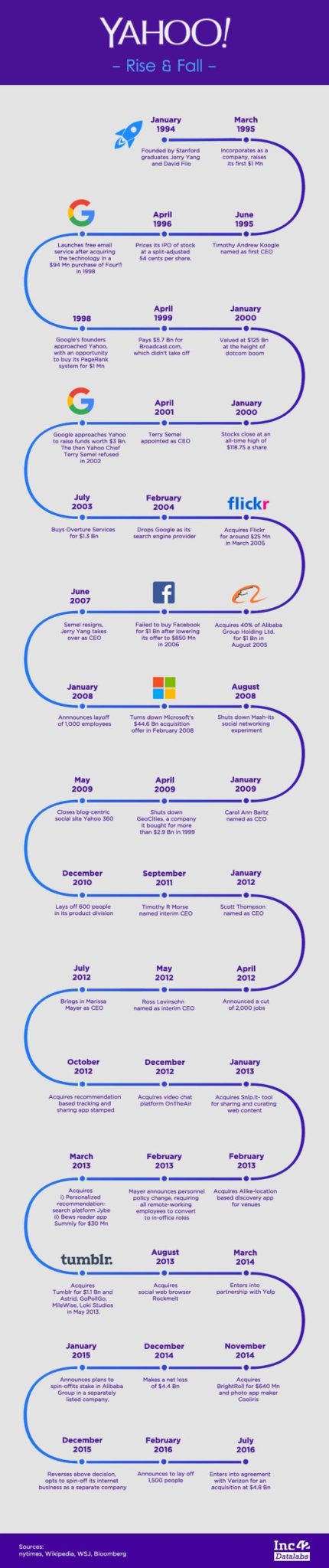

Yahoo which in its prime days was as big as Facebook and Google is now transitioning into a holding company. Founded in 1994, it was a dominant player in the early days of the internet with its market cap reaching $125 Bn at the height of the boom in 2000 but has long lost its leadership position to Google and Facebook. Twice, it failed to invest in Google, a decision that could have probably been a turnaround in its story. Here’s looking at some brief facts about it

Yahoo Timeline

The deal with Verizon is a direct result of the mounting pressure by investors on CEO Marissa Mayer to cut costs and sell off core assets as the company was stricken by stalling growth and a sliding stock price. Some of Yahoo’s investments decisions such as the acquisition of Broadcast.com for $5.7 Bn which did not take off and that of Tumblr for $1 Bn in 2013, which now is valued at $230 Mn backfired, adding fuel to the fire.

Mayer who joined Yahoo in 2012 has not been able to bail out the company from its downfall. Last week, the firm reported a $440 Mn loss in the second quarter, but said the board had made “great progress on strategic alternatives”. Interestingly, Marissa’s plan to spin-off Yahoo’s stake in Alibaba was scrapped last year in favour of selling the search and advertising business. In February, Yahoo had cut 15% of its global workforce.

Though Yahoo is still one of the most heavily trafficked home page with hundreds of millions of customers using its email, finance, and sports offerings, among others, yet Google has a strong hold on the Internet search business while Facebook dominates in mobile and social media. Also, traditional web banner advertising, which was Yahoo’s forte, has become much less lucrative in the age of mobile and video. While Facebook’s mission is to connect the world, and Google’s is to organise the world’s information, Yahoo also suffered on account of no clear mission as it swung from being a web portal to a media company to both, churning through five CEOs in six years.

So while Verizon is banking on its large user base to build a powerful media company with AOL and unleashing Yahoo’s full potential, how strongly it can stand up to giants like Google and Facebook will be interesting to watch. For Yahoo, which was once a $125 Bn valued business to sell for $5 Bn, it might not exactly be a happy day. Though Marissa Mayer states, “The sale of our operating business, which effectively separates our Asian asset equity stakes, is an important step in our plan to unlock shareholder value for Yahoo. With more than 100 million wireless customers, a shared view of the importance of mobile and video ad tech, a deep content focus through AOL, Verizon brings clear synergies to the table. And with their aggressive aims to grow the global audience to 2B users and $20B in revenue within the mobile media business by 2020, Yahoo’s products and brand will be central to achieving these goals.”

However, the takeover, which is due to be completed in early 2017, raises questions about whether the Yahoo brand could disappear. For a company “that humanised and popularised the web, email, search, real-time media, and more”, Marissa adds that “This is a good moment to reflect on Yahoo’s journey to date.”

Is it? The final price is a mile away from the $45 Bn which Microsoft had offered in 2008 and Yahoo’s brand has taken a beating in recent years. With Google being the default for search and Facebook for social, is it possible that under Verizon, people might start caring about Yahoo again? If they do, in retrospect, Mayer’s words about a good moment might hold true. For now, it will have to contend with the $5 Bn it has fetched after a protracted sale.

[Graphics by Satya Yadav]